Protecting Your Creative Legacy: Why Your Intellectual Property Belongs in Your Estate Plan

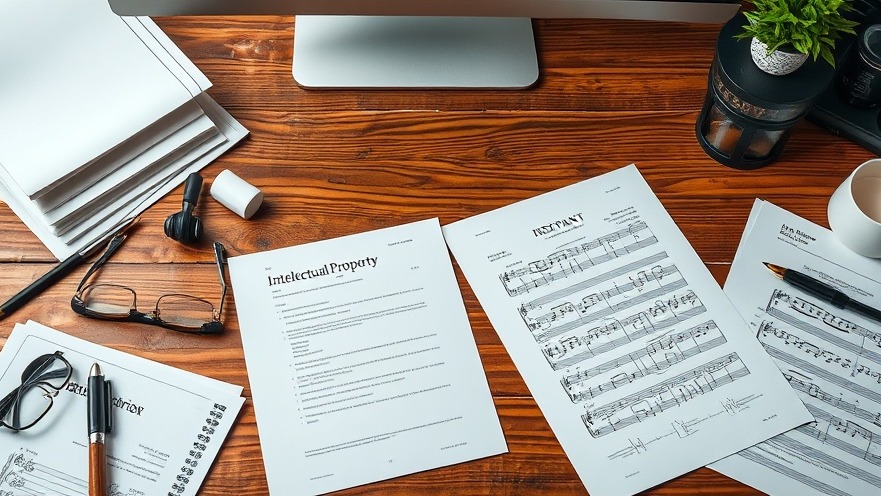

When thinking about estate planning, many individuals center their minds on tangible assets—homes, vehicles, and savings accounts. However, intellectual property represents a significant and often overlooked part of one's wealth.

For creators and innovators, your intellectual property (IP) – from a cherished musical composition to the innovative software that distinguishes a business – holds immense, often underappreciated value.

Understanding how to safeguard these assets is crucial for ensuring your hard work continues to benefit your loved ones and that your legacy flourishes. This article will guide you through the essential steps to incorporate your intangible assets into your estate plan, providing peace of mind for tomorrow.

Step One: Inventory Your Intangible Treasures

The first step in protecting your intellectual property is to make a comprehensive inventory. This inventory should encompass copyrights, trademarks, patents, trade secrets, and licensing agreements. Documenting these assets, along with their legal status, ensures that your loved ones can smoothly manage their distribution, effectively preserving your creative legacy.

Why Estimating Your IP Value is Essential

Many individuals overlook the financial potential of their IP. Valuation isn't just good practice: it can highlight opportunities for ongoing income through royalties or licensing fees. Accurate estimation aids in determining how to distribute or secure these valuable assets.

Choosing the Right Tool for Management: Will vs. Trust

In estate planning, the choice between a will and a trust is vital. While a will might outline who inherits your IP, it is often routed through a lengthy probate process, potentially jeopardizing its privacy and efficiency.

A revocable living trust can be a more effective alternative, promoting a seamless transfer of ownership—an option particularly beneficial for creators seeking to ensure their heirs receive ongoing payments from their work.

Assigning the Right Trustee for IP Management

Managing intellectual property assets requires specific knowledge that not every family member might possess. By appointing a trustee or executor well-versed in IP rights, you can assure the continuation of your legacy.

Think of it as entrusting your creations—whether they’re songs that carry emotional weight or a patented invention that could impact lives—to someone who truly understands their significance.

The Importance of a Diligent Estate Plan

The importance of incorporating intellectual property into estate plans cannot be overstated for creators and business owners. Protecting these assets not only safeguards your hard work but allows your legacy to flourish. Crafting a diligent estate plan that encompasses these elements can foster both security and assurance for your beneficiaries.

As we approach our futures, it’s essential to recognize and articulate the value of our intellectual creations. Whether it’s through careful inventory, strategic valuation, or selecting a knowledgeable trustee, proactive steps today can yield peace of mind for tomorrow.

Add Row

Add Row  Add

Add

Write A Comment